This article, “PM CARES Fund- Opaqueness of Transparency” is written by Ashutosh Rajput. He is a student of Hidayatullah National Law University & Campus Ambassador Legal Thirst. In this article he puts the question on the PM Cares Fund; that whether it is covered under RTI, 2005 or not? Whether it is relevant to hide the transparency on the name of a donation fund? Read below…

Table of Contents

Introduction:

On 29th May 2020, the Prime Ministers Office stated that; the “PM CARES fund is not a public authority under the Right to Information Act, 2005.” This came in response when the RTI was filled by one law student named Harsha Kandukuri. Recently, a PIL has also been filed before the Delhi High Court by one Mr. Hooda to enforce the right to information wherein he contended that; many people from different sectors compulsorily contributed to the fund; and not letting them know their contribution will directly infringe their rights.

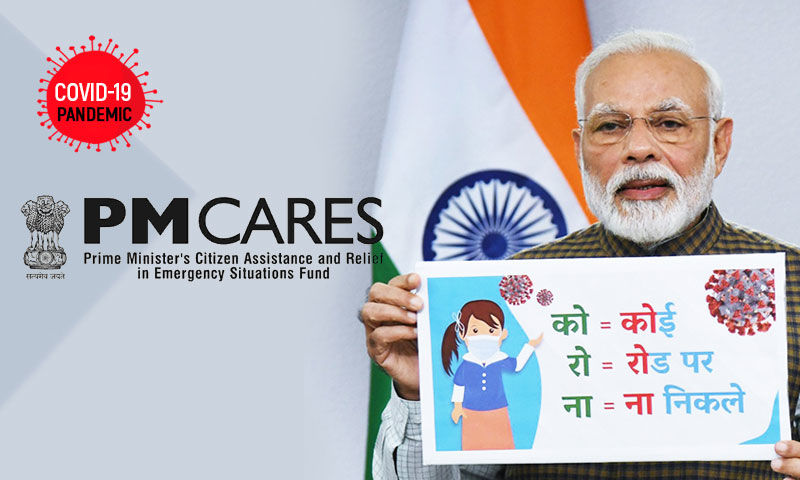

PM CARES stands for Prime Minister’s Citizen Assistance and Relief in Emergency Situations; and was created on March 28 with a view to handle the COVID-19 crisis economically as well as socially. Narendra Modi is its ex-officio chairman while its ex-officio trustee consists of Rajnath Singh, Amit Shah, and Nirmala Sitaraman. It presumes voluntary donation by the democracy for the good cause; and till now total donation received amounts to rupees 10,000 Crores. Before the introduction of the PM Cares fund, the Prime Minister National Relief Fund (PMNRF) was prevalent which was setup up in 1948 and had more than 3,800 Crores rupees as a fund; which led to its criticism by the opponents.

Pros of the PM CARES:

As stated earlier the funds received are voluntary and are not compulsory; and the minimum amount to be donated is rupees 10; which is negligible and can be donated by all classes of the community. Foreign donations under the Foreign Contribution (Regulation) Act are also allowed.

The funds received will be used to improve the lives of migrant workers, to purchase the ventilators; and will provide monetary support for the COVID-19 vaccine, pertaining to this; the fund collection has 100% tax exemption under 80G of Income Tax Act, 1961. PM Cares is dedicated to this pandemic situation unlike PMNRF; which is for all types of disasters; and the later one has a legislative concern as it comes under the consolidated fund; while the former is solely based on donation-based funds; therefore, does not have a legislative concern.

Legal Provisions governing PM CARES:

- Section 2(h) of RTI Act, 2005: It defines public authority as any authority or body or institution of self-governance; established or constituted by the constitution or by any law under the Parliament; or by the state legislature or by a notification issued by the appropriate government. And also includes other bodies and NGO’s owned, controlled or substantially financed.

- Section 13(b) of CAG Act, 1971: It gives general provisions relating to audit wherein it states that; it shall be the duty of the CAG to audit all transactions of the Union; and of the States relating to Contingency Fund and Public Accounts.

- Section 46 of the Disaster Management Act, 2005 (DMA): It has a provision for the formation of the National Disaster Fund; and that amount shall be credited to the Central Government after due appropriation made by the Parliament.

Why it has been criticized?

- Firstly meaning of public authority is given under the Right to Information Act, 2005; and the following points would likely to make PM Cares a public authority in the eyes of democracy-

- The name itself starts with ‘Prime Minister’ and according to the Emblem & Names Act of 1950; it can only be used by the government.

- The activities of ‘PM Cares’ is also mentioned in the Prime Minister’s official website.

- There was usage of emblem though it is still not termed as a public authority.

- The composition of trust consists of members from one party only.

- It is a public charitable trust.

Hence it is prima facie a public authority and is answerable to the public.

In Prime Ministers National Relief fund v. Aseem Takyar, it was also held that as per Section 2(h)(d)(i) PMNRF is a ‘public authority’.

- Secondly, there is a provision on the website of PM Cares, that the Chairperson (Prime Minister) shall nominate three other trustees; and such trustees shall act in pro bono capacity but still; such nomination has not been done till date.

- Thirdly, the very donation is termed as a voluntary donation; but on the other hand; the Finance Minister requested its employees to compulsorily donate their single day’s salary per month till March 2021. Then such donation cannot be termed as a voluntary donation with respect to PM Cares.

- Fourthly, the officials stated that to overcome the ‘legal hurdles’ caused by PMNRF; the new fund namely PM Cares was introduced. But it is the duty of government to make public informed about all the sanctions made through their donations; and mere submission of annual reports, accountability before the Parliament would not come under the ambit of ‘legal hurdles’.

- Fifthly, as per section 2(d) of the Disaster Management Act, 2005, COVID-19 comes under the ambit of disaster and PMNRF was made for such disaster; therefore, it prima facie shows that there is no need of PM Cares; if we have sanctioned existing fund which is more transparent than the later.

- Sixthly, the composition of the trust is the whole of the ruling party; which presumes the creation of monopoly over the fund as the CAG will only have obligation to audit; when the entire trustee agrees for the same.

- Seventhly, the fund is created irrespective of the provisions given under section 46 of the DMA.

Conclusion:

It can be concluded that PM Cares is a public authority; and in order to gain people’s trust, there has to be transparency. And every citizen has a right to information. It still does not matter; if it is a private trust or a public trust, it is made for a good cause; and there should be no hesitation on the government’s part to reveal the fund received and spend respectively. PMNRF too was not that transparent but in 2012 the then PMO has furnished the information in regards to PMNRF. The opaqueness of the fund would prima facie lead to the breach of trust.